Vendor Day — the best way to find out ALL services offered by your TPA. Most TPAs provide adequate services, but you need to know about those services in order to ask for the service!

A TPA (third-party administrator) is an independent company used to adjust claims. Sometimes your insurance company will use a TPA hired by your company if your insurance company allows you to unbundle.

TPA’s focus on administering workers’ compensation benefits in accordance with state laws. “Unbundling” occurs when an insurance company allows the employer to use a TPA.

As always, it is important to understand the process involved in handling workers’ compensation cases. One of the best ways to do this is to request a Vendor Day. The company, insurance company, broker or consultant can request this for a specific date, time and location.

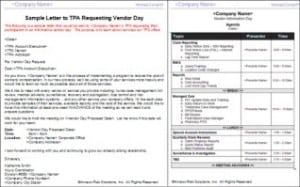

A letter to your TPA should demonstrate that your company is in the process of implementing a program to reduce the cost of workers’ compensation. Explain that since your company has a new system, it will be using some of the TPA’s services more heavily, want to take advantage of ALL services and would like to learn as much as possible about all of those services.

Some of the vendors you need to meet with and understand include:

1. Nurse case management and Senior Nurse Reviewers

2. Bill review

3. Medical advisors

4. Surveillance

5. Recovery and subrogation

6. Loss control and risk management information systems

7. Any other service the TPA offers

In your letter, tell the TPA you would like them to provide samples of their services, available reports, and the cost of the service. And also let them know you need the information at least one week in advance of the meeting so your company can read it and prepare questions. (workersxzcompxzkit)

Workers’ compensation is an important part of your business and it is critical to stay on top of all aspects of the process. Trusting that “the insurance company will handle it” is not an effective tool. All tools are available in www.WorkersCompKit.com

Author Robert Elliott, executive vice president, Amaxx Risks Solutions, Inc. has worked successfully for 20 years with many industries to reduce Workers’ Compensation costs, including airlines, health care, manufacturing, printing/publishing, pharmaceuticals, retail, hospitality and manufacturing. He can be contacted at: Robert_Elliott@ReduceYourWorkersComp.com or 860-786-8286.

We are accepting short articles* (200-600 words) on WC cost containment. Contact us at: Info@WorkersCompKit.com. *Non-compensable.

WC Best Practices IQ Test: http://www.workerscompkit.com/intro/

WC Books: http://www.reduceyourworkerscomp.com/workers-comp-books-manuals.php

NEW Article: Return to Work in Unionized Companies

http://reduceyourworkerscomp.com//Return-to-Work-Programs-Unionized-Companies.php

Do not use this information without independent verification. All state laws vary. You should consult with your insurance broker about workers’ comp insurance issues. ©2008 Amaxx Risk Solutions, Inc. All rights reserved under International Copyright Law. If you would like permission to reprint this material, contact Info@WorkersCompKit.com