One of the main goals in managing workers' compensation costs is returning your injured worker to …

Why Every Employer Should Request Their Account Handling InstructionsRead More

One of the main goals in managing workers' compensation costs is returning your injured worker to …

Why Every Employer Should Request Their Account Handling InstructionsRead More

TPA Medical Management Critical for Cost Containment The third party administrator (TPA) who …

Wrong Job Classification Codes Costs Employers Money Employers who have a complete safety program, …

You May Be Doing The Right Thing And Still Paying Too Much Workers CompRead More

It is pretty hard to be proactive on your injury claims if you struggle to get the claim to your …

How Your Carrier or TPA Should Process Claims IntakeRead More

Employers often wonder does the workers compensation agent or broker work for them or does the …

Understanding Key Differences Between Insurance Agents and Insurance BrokersRead More

Let me first point out this article is written from the Claims Adjuster’s point of view. This will …

Six Things An Employer Should Tell the Adjuster About the Workers Compensation ClaimRead More

Average claim life continues to increase due to the injury severity and increasing medical …

Five Ways to Control Skyrocketing Workers Compensation Claim CostsRead More

When you have a high-exposure file that turns out better than you had expected and costs come in …

Four Useful Tips Can Go a Long Way in Managing Workers CompRead More

In the world of insurance, it is hard to tell if your carrier or third-party administrator (TPA) is …

It is not easy being an adjuster – worried claimants, demanding plaintiff attorneys, state forms, …

Work comp operates under certain presumptions, one of which is that unless an employer provides …

No News is NOT Good News, When Managing Work Comp ClaimsRead More

If your company is considering placing its general and/or auto liability with your …

If your company is considering placing its general and/or auto liability with your …

Stopping Fraud with Video Proof 3 Action Steps to Use When Contacting Your TPA Once you …

How to Use Video Proof of Fraud to Settle Workers Comp ClaimsRead More

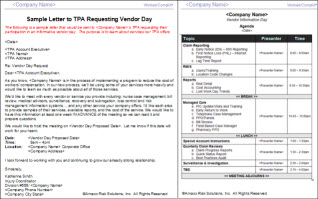

Vendor Day -- the best way to find out ALL services offered by your TPA. Most TPAs provide adequate …

How To FIND Out EVERYTHING Your Third Party Administrator ProvidesRead More

Workers Compensation Diary of a Consulting Project -I will share some of my experiences …

Diary of a Consulting Project Visiting the TPA’s OfficeRead More

MYTH: The best way to reduce workers' compensation costs is to change insurance companies or …

Try Other Options Before Changing Insurance Company or TPARead More