We all know it is the employer's responsibility to purchase workers' compensation insurance …

6 Minimum Expectations For Employer Involvement in Workers’ CompRead More

We all know it is the employer's responsibility to purchase workers' compensation insurance …

6 Minimum Expectations For Employer Involvement in Workers’ CompRead More

There is one feeling and one emotion that when intentionally done can have more impact on you …

If you leave the management of the workers' compensation claims to chance, the chances are you will …

Workers’ compensation laws only cover “employees” of the employer. While this may seem like a …

Are You an Employee? Issues Concerning Independent ContractorsRead More

If you’re trying to improve your workers’ comp program, ask for an annual stewardship meeting with …

10 Ways to Kick Start a Workers’ Comp Stewardship ProgramRead More

Nearly every claims management team is looking for the silver bullet to cure all their workers’ …

Quick Claim Reporting – The Workers’ Comp Silver BulletRead More

The most important and meaningful thing in life is the relationships that we are in. Hello, my name …

Supervisors play an essential role in the claims process following a work injury. The problem is …

Attention Supervisors: What Are Your Post-Injury Responsibilities?Read More

In order to go from good to great. You first need to get the right people on the bus, the wrong …

Looking at employees with fresh eyes when they get injured is an incredible …

A Work Comp Injury Is Invaluable Opportunity to Look with Fresh EyesRead More

Urban legend and stereotype opinion say traveling employees have it made. They see large parts of …

Keep Work Comp Costs Grounded With Travelling EmployeesRead More

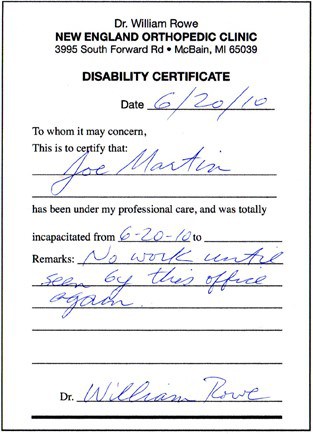

“Off-Work” disability doctor notes from employees stipulate that employers allow injured workers to …

The injured employee is the reason workers’ compensation laws exist. Without employees and their …

Protecting the Injured Employee in Workers’ Compensation is ParamountRead More

Can you name the one person throughout the course of a worker's comp claim that within about 10 to …

3 Essential Elements to Supervisor Response That Will Save 40 PercentRead More

Strong company culture is not only a pleasant place to work, but it has also been associated with …

The 5 Building Blocks Of a Positive Corporate Culture: Part IIIRead More

Strong company culture is not only a pleasant place to work, but it has also been associated with …

The 5 Building Blocks Of a Positive Corporate Culture: Part IIRead More

Why do employees go to work every day at a particular organization? Is it the paycheck? The people? …

The 5 Building Blocks Of A Positive Corporate Culture: Part IRead More

Hey there, Michael Stack here, CEO of Amaxx. This past weekend, over the Labor Day …

As an employer, you often hear the recommendation “stay involved in your workers' compensation …

The Four Phases of Employer Involvement In A Workers’ Comp ClaimRead More

To have a successful, effective workers’ compensation program requires commitment from …

5 Ways to Get Management Buy-In for Your Workers’ Compensation ProgramRead More