Paradigm, the industry leader in solving catastrophic and complex health care challenges and …

Paradigm Receives 2022 Great Place to Work CertificationRead More

Paradigm, the industry leader in solving catastrophic and complex health care challenges and …

Paradigm Receives 2022 Great Place to Work CertificationRead More

On Wed, May 11, 2022 1:00 PM - 2:00 PM EDT, Join Alisa Hofmann, and Diedra Rae as they address the …

Webinar to be held: 05/03/2022 | 11:00 am PT Register Here CE Credit Information This live, free …

OVERVIEW What will the future of Medicare Set-Asides look like? How are Medicare Set-Asides and …

Tips for Navigating the Evolving Medicare Set-Aside LandscapeRead More

With the news of world events of Russia's invasion of Ukraine fresh in my mind, i …

"Before anything else, preparation is the key to success." That statement, by Alexander Graham …

Leverage a Settlement Team for Optimal Claim Settlements Read More

ONE HOUR CONTINUING EDUCATION (CE) CREDIT FOR ADJUSTERS ONLY Overview Join us for an informative, …

Overcoming Objections to Achieve Optimal Settlement OutcomesRead More

Risk & Insurance Full article on riskandinsurance.com As workers’ compensation moves toward …

Episodes of Care Has the Power to Transform RecoveryRead More

Collaboration to deliver better outcomes and greater predictability in patient recoveries WALNUT …

Paradigm and Shirley Ryan AbilityLab Announce First-of-Its Kind, Value-Based PartnershipRead More

Speakers Michael Choo, MD, FACEP, FAAEM, Chief Medical Officer, Paradigm Kathy Galia, RN, …

The Future of COVID-19—Vaccines and the Trajectory of CareRead More

Paradigm Catastrophic Care Management CEO Kevin Turner recently shared, with Michael Stack …

Kevin Turner Featured in AMAXX Webinar on Catastrophic Workers’ Comp Claim StrategiesRead More

Paradigm, the industry leader in solving catastrophic and complex health care challenges and …

WALNUT CREEK, CA - Paradigm, the industry leader in solving catastrophic and complex health care …

Success in effective claim management starts with a proper investigation. When it is not done …

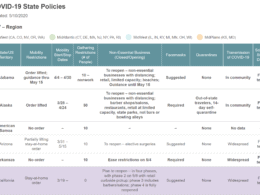

As companies are navigating returning employees back to work from the Covid-19 pandemic. Here is a …

As companies have prepared to restart and ramp up operations in the past few weeks, they’ve worked …

Is Your COVID-19 Messaging Getting Through to Your Employees?Read More

Partnership Complements Paradigm's Whole Person, Whole Family Approach to Improve Outcomes for …

Industry’s First COVID-19 Program Assists Injured Workers Requiring Intensive Medical Care and …

Vocational rehabilitation services play an important role in returning injured employees back to …

Using a Disability Case Manager in Vocational RehabilitationRead More

The WorkSTEPS team continues to carefully track what is happening with the COVID-19 pandemic. The …