Top 5 Take Away Points from 2017 National Workers' Comp & Disability Conference - …

Top 5 Take Away Points from 2017 National Workers’ Comp & Disability Conference – Part 2Read More

Top 5 Take Away Points from 2017 National Workers' Comp & Disability Conference - …

Top 5 Take Away Points from 2017 National Workers’ Comp & Disability Conference – Part 2Read More

Top 5 Take Away Points from 2017 National Workers' Comp & Disability Conference - Part 1 Top …

Top 5 Take Away Points from 2017 National Workers’ Comp & Disability Conference – Part 1Read More

While murders in the workplace make the six o'clock news, injuries due to physical assault in the …

You want to make sure your injured workers get the benefits they need to recover and get back to …

7 Steps to Manage Occupational/Environmental Exposure ClaimsRead More

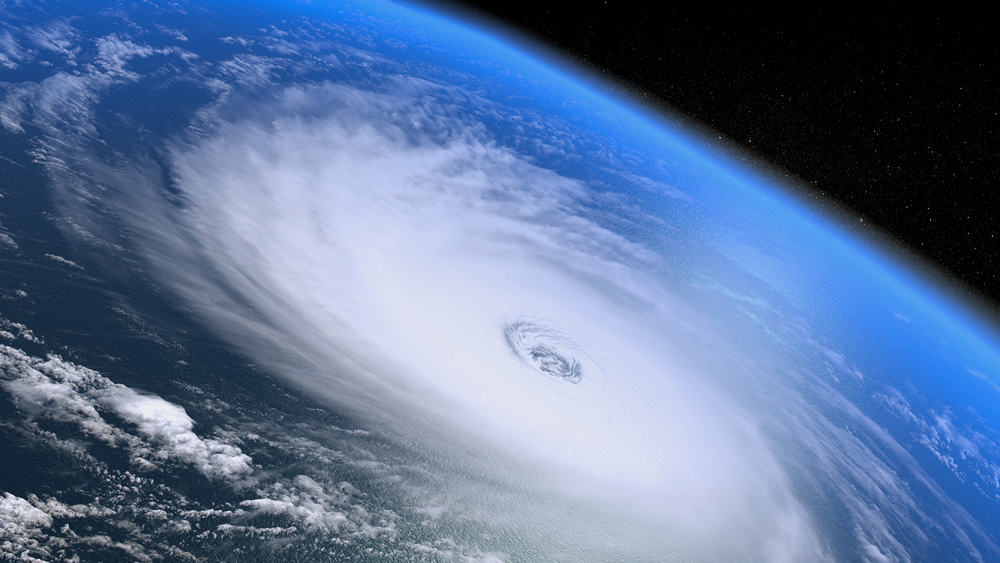

The devastation caused by hurricanes Harvey, Irma and Maria underscores the seriousness of these …

Hiring unqualified people to fill positions within the workforce is by far one of the biggest …

Hiring Unqualified People Is Big Worker’s Comp MistakeRead More

The changing American workforce requires workers’ compensation professionals and stakeholders to …

Reducing Work Comp Cost via Focus on Cultural CompetenceRead More

Hey there Michael Stack here. I'm the CEO of Amaxx and I'm also the founder of the Amaxx …

Relieve Workers’ Comp Burden by Assessing Honesty, Resiliency, and AttitudeRead More

Imagine walking into your office, turning on your computer, and seeing nothing but a message …

They come in all types of gadgets. Wristbands. Watches. Eye glasses. They can be woven into your …

Workers’ Comp Should Embrace Wearable Technology with CautionRead More

Enterprise Risk Management (ERM) gives a holistic view of all risk across the enterprise and allows …

Three Common Mistakes In Enterprise Risk ManagementRead More

Once a company is successfully able to implement the foundation of their Enterprise Risk Management …

Business Map to Workers Comp In Enterprise Risk ManagementRead More

Donald Trump, the House, the Senate, 68 out of 99 State Legislative Chambers, and the …

WCRI Preview: Impact of Trump, Congress, & Legislature on Workers CompRead More

Many serious discussions took place during 2016 that required claims management teams to examine …

The term risk takes on a new meaning to forward thinking organizations. As noted by a leading …

Piece Workers’ Comp Into the Enterprise Risk PuzzleRead More

Collecting and prioritizing risk data is only valuable if your organization has a way to transition …

Top 5 Take Away Points 2016 National Work Comp & Disability Conf - Part 1 Top 5 Take Away …

Top 5 Take Away Points 2016 National Work Comp & Disability Conf – Part 3Read More

Top 5 Take Away Points 2016 National Work Comp & Disability Conf - Part 1 Top 5 Take Away …

Top 5 Take Away Points 2016 National Work Comp & Disability Conf – Part 2Read More

The CFO is the most qualified to provide CEO and board operational insight. In most business …

Everyone remembers where they were the when they learned the World Trade Center crumbled to the …

September 11th Remembered – Tribute To Marsh And AONRead More