I always laugh when I hear my friend talk about the fact that “Big brother is watching us.” …

Surveillance Cameras Can Make Difference In Work Comp ClaimsRead More

I always laugh when I hear my friend talk about the fact that “Big brother is watching us.” …

Surveillance Cameras Can Make Difference In Work Comp ClaimsRead More

Adjuster Will See Thousands of Claims Throughout the course of an adjuster’s career they will …

Is Your Adjuster Playing Favorites With Your ClaimsRead More

Best Practices Approach to Post-Loss Costs Containment. A solid workers’ compensation cost control …

Identify Real Cost Drivers in Post Loss Workers CompensationRead More

Deer Season Can Equal Spike in Work Comp Claims Fall has arrived. Time is say goodbye to days at …

It is Deer Hunting Season, Be Aware of a Spike in Work Comp ClaimsRead More

According to a new report from New Hampshire’s Department of Health and Human Services, merely half …

Many Injured on Job in New Hampshire Did Not Receive Workers Comp CoverageRead More

We often hear about “best practices” for workers compensation claims-handling …

Three Areas Where Best Practices for the Employer Can Make a DifferenceRead More

Some thoughts on whether being "average" is good enough... What does it cost to buy a …

To maximize your company’s potential for workers’ comp cost containment we recommend …

Eight Focus Areas for Best Practice Cost Containment of Workers CompensationRead More

Small changes in your workers’ compensation program lead up to large cost savings. Your company’s …

Assessment is Your Number One Tool for Cost ControlRead More

From time to time an external claims auditor comes across a workers' compensation claim approaching …

15 BEST PRACTICES Picture Perfect Handling of a Workers Comp ClaimRead More

While there are a variety of programs to reduce workers' compensation costs, there are …

Does YOUR Company Use These 5 Basic Practices to Lower Workers Comp CostsRead More

Communications, is key to good inter-personal relationships. Communicating is even more critical …

Supervisors are the front-line reporters of work-related injuries and accidents and bear the …

What are Supervisors Best Practices When Handling Workers Comp Related InjuriesRead More

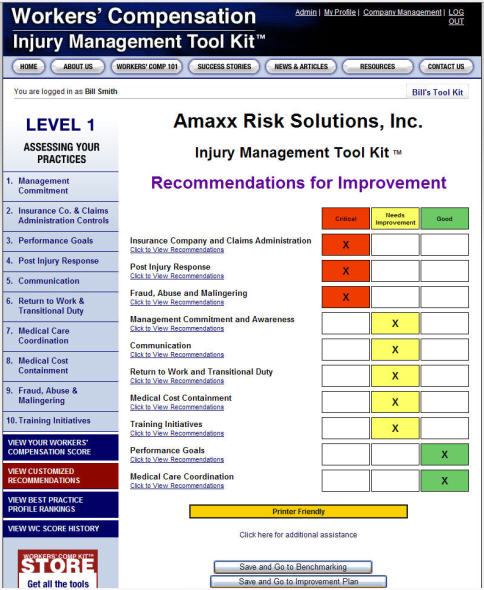

When improving your workers' compensation programs, it's important to prioritize the …

Prioritize Best Practices in Workers Compensation ProgramsRead More

As a productive member of your workforce, employees must participate in your Workers' …

Nine Employee Responsibilities in Best Practice Cost Containment ProgramRead More

Our National Workers' Compensation Management Scores™ are numeric scores ranked for 1-100. Yes, you …

National Workers Compensation Management Scores™ are Quantifable — Best Practices MeasuredRead More