If an employer has a high exposure workers’ compensation claim, which scenario is more …

Professional Administration Closes Workers’ Comp Claim FilesRead More

If an employer has a high exposure workers’ compensation claim, which scenario is more …

Professional Administration Closes Workers’ Comp Claim FilesRead More

Moving legacy claims to settlement is a primary goal of organizations. Yet getting there is easier …

There’s a relatively new trend in the workers’ compensation space that puts more focus on the …

Professional Administration Key Performance IndicatorsRead More

You settled a workers’ compensation case with an injured employee. Now what? This is a question …

Avoid Legal Issues After Settling A Workers’ Comp ClaimRead More

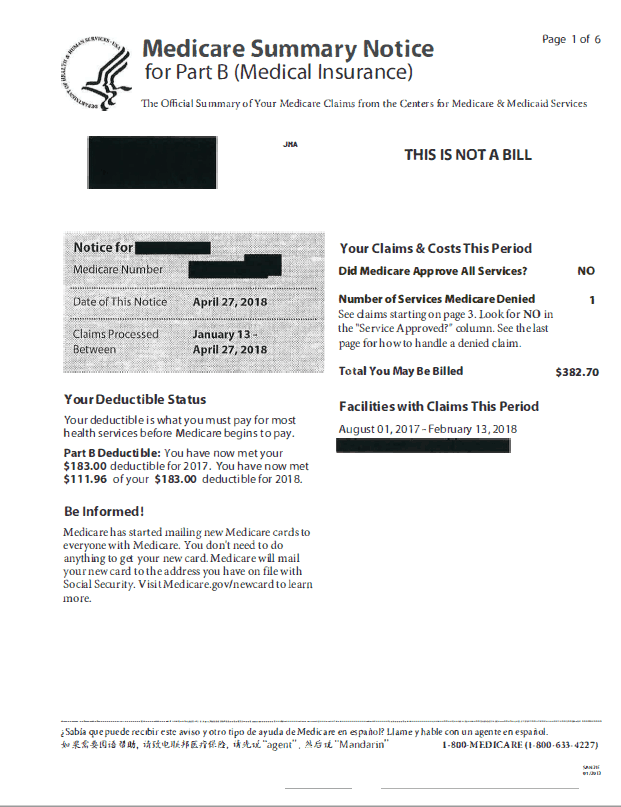

Following the resolution of a workers' compensation claim that includes payment for future medicals …

Struggles & Risks in Self-Administering Workers’ Compensation Medicare Set AsidesRead More

Historically workers’ compensation insurers and employers avoided “psych” claims for fear that …

Starting April 1, 2020, Workers’ Compensation Medicare Set Asides (WCMSAs) that are submitted to …

CMS Revises Its Consent to Release Form – How Should The Industry Respond?Read More

Navigating through complex settlement options can be difficult. Having a resource, like a …

Special Needs Trust Basics: What Should I Consider?Read More

It’s not often you hear of the government endorsing a particular service in the private sector. …

5 Criteria to Choose the Right Professional AdministratorRead More

The Centers for Medicare and Medicaid Services (CMS) asserts it has the right to deny paying for a …

Injured individuals across the country are settling claims every day and often they have no idea …

Case Study: Double the Ongoing Medical Treatment From Injury SettlementRead More

Setting up support with professional administration of medical funds after settlement is a clear …

5 Key Terms That Define Professional Administration ContractsRead More

Wilmington, Mass. (February 19, 2019) – Paul H. Sighinolfi has joined the Ametros Senior Leadership …

Paul H. Sighinolfi Joins Ametros as Senior Managing DirectorRead More

Some leading US companies offer a unique perk for injured workers who settle their claims with …

A Unique Perk For Workers with Limited or No Health InsuranceRead More

As much as some injured workers’ complain about workers’ compensation, the system has some perks …

Overcome Catastrophic Claim Settlement Resistance With SupportRead More

The combination of professional administration with a structured settlement (annuity) is often the …

Injured workers with long-standing claims and ongoing medical concerns are often hesitant to settle …

6 Ways Post-Settlement Professional Administrators Can Provide Peace of MindRead More

A new research brief on MSAs and Workers’ Compensation by the National Council on Compensation …

NCCI Report Recap: How Professional Administration Factors InRead More

1. “What is my risk if my client makes mistakes with their MSA?” 2. “What’s the chance that …

8 Questions from Attorneys about Medicare Set Aside AdministrationRead More

An injured worker with an open claim for 15 years finally agreed to settle, and it all came down to …

Move Workers’ Comp Claims to Settlement with EmpathyRead More