Reducing workers’ compensation program costs requires all interested stakeholders to understand its …

Part 1 of 5: Work Comp and the Grand Bargain- A PrimerRead More

Reducing workers’ compensation program costs requires all interested stakeholders to understand its …

Part 1 of 5: Work Comp and the Grand Bargain- A PrimerRead More

In the workers’ compensation claims world, a commonly held belief is “the more settled claims, the …

4 Times When a Workers Comp Claim Should NOT Be SettledRead More

Surveillance can be an effective tool to reduce costs in a workers’ compensation program. While …

Avoid Ethical and Legal Pitfalls In Workers’ Comp SurveillanceRead More

Monitoring and managing workers’ comp transportation expenses can drastically improve the claim …

Controlling Work Comp Transportation Expense Is More Than Ordering an UberRead More

The old adage “Time is Money” definitely applies to the handling of workers' compensation claims. …

6 Elements To Review In Your Adjuster’s Action PlanRead More

When you say catastrophic injury, many people in the insurance field think of brain injuries, …

Two Very Important Steps When Managing A Catastrophic Injury ClaimRead More

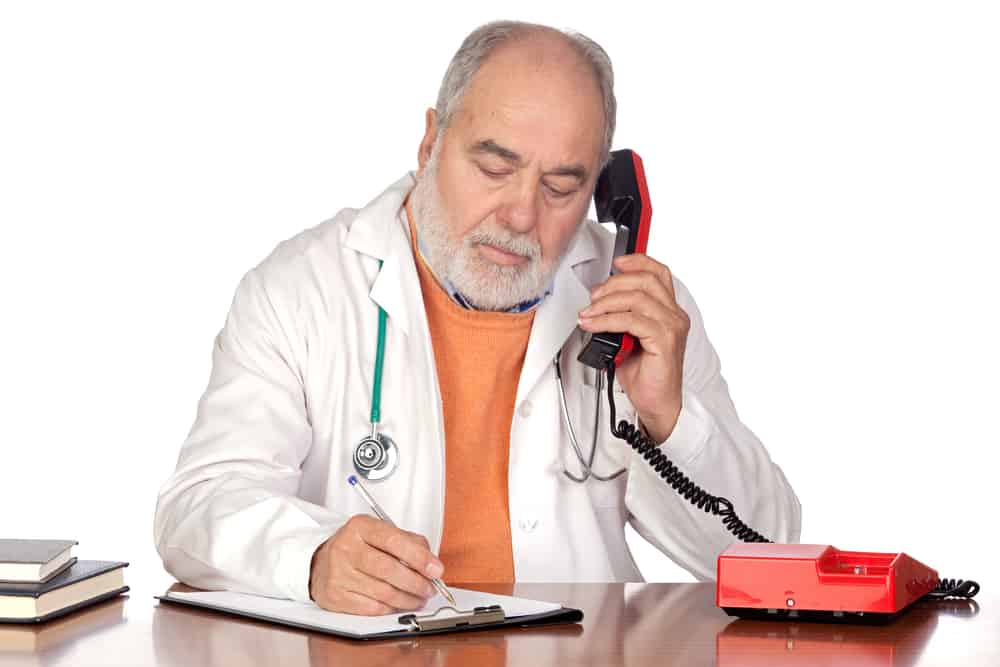

Leaving no stone unturned is critical to managing your workers' compensation costs. With the number …

9 Questions to Ask Injured Worker’s Treating PhysicianRead More

A company medical advisor can be one of the most effective tools for reducing workers’ compensation …

Use A Medical Advisor To Maximize Value of Independent Medical ExamRead More

We all know it is the employer's responsibility to purchase workers' compensation insurance …

6 Minimum Expectations For Employer Involvement in Workers’ CompRead More

Winter presents several challenges for the claim management team and interested stakeholders …

Nurse case managers (NCMs) coordinate medical care and determine the extent of disability. …

How to Tell If You Need a Nurse Case Manager for Your Workers Compensation ClaimRead More

Despite your best efforts to get medical restrictions from all treating physicians and evaluate …

8 Part Email To Send When Transitional Duty Doesn’t WorkRead More

The COVID-19 pandemic changed the landscape of workers’ compensation in the United States. While …

Trends in Work Comp Legislation: Long-COVID PresumptionsRead More

Do you ever wonder if the claim handling quality of your insurer or third party administrator (TPA) …

Is Your TPA Recovering Every Subrogation Dollar It Should?Read More

This post is one in a 3-part series: Execute a Bulletproof Workers' Comp Claim Investigation …

Execute a Bulletproof Workers’ Comp Claim Investigation – Part 3Read More

There is significant opportunity to increase the level of satisfaction and security in workers’ …

Surveys Results: People Often Regret Choice of Lump Sum SettlementRead More

For some time, chiropractic care has been a mainstay in workers’ compensation systems. While there …

Address 3 Areas of Concern For Chiropractic Care in Work CompRead More

This post is one in a 3-part series: Execute a Bulletproof Workers' Comp Claim Investigation …

Execute a Bulletproof Workers’ Comp Claim Investigation – Part 2Read More

Workers’ compensation claims professionals and other interested stakeholders face many challenges …

3 Times to Consider the ADA in Workers’ CompensationRead More

When dealing with cost containment in workers’ compensation, focus is often given to the medical …

4 Ways to Minimize Workers’ Comp Indemnity ExposureRead More